cimb transfer money overseas | cimb money transfer

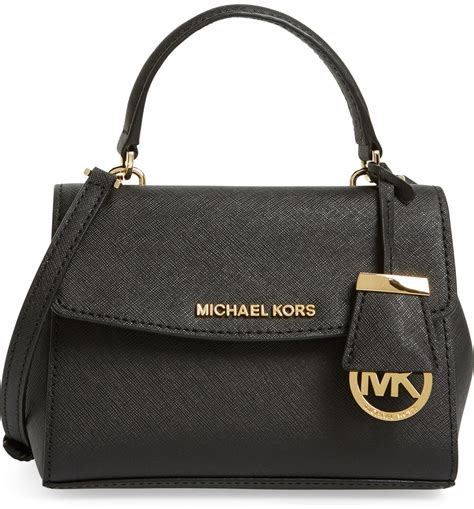

$246.00

In stock

In today's increasingly interconnected world, the need to transfer money overseas is more prevalent than ever. Whether you're supporting family abroad, paying for international education, investing in foreign markets, or simply sending a gift to a loved one, a reliable and efficient money transfer service is essential. CIMB, a leading ASEAN universal bank, offers a comprehensive suite of solutions for transferring money overseas, catering to diverse needs and preferences. This article delves into the various options available through CIMB, highlighting their features, benefits, and how you can leverage them to make international money transfers seamless and cost-effective.

We will explore the various aspects of CIMB's international money transfer services, covering topics like Foreign Telegraphic Transfer (TT), SpeedSend, utilizing CIMB Clicks web and CIMB OCTO App, foreign exchange rates, supported currencies and countries, and crucial information regarding security and compliance. We will also touch upon specialized services like those available to CIMB Preferred customers and address frequently asked questions to ensure you have a complete understanding of how to transfer money overseas with CIMB.

Understanding Your CIMB Overseas Transfer Options

CIMB provides several avenues for transferring money internationally, each with its own advantages and suitability for different situations. The primary methods include Foreign Telegraphic Transfer (TT) and SpeedSend, both accessible through CIMB Clicks web or the CIMB OCTO App. Let's examine each of these in detail:

1. Foreign Telegraphic Transfer (TT): A Reliable Choice for Larger Transfers

Foreign Telegraphic Transfer (TT) is a traditional and widely recognized method for transferring money internationally. It involves electronically transmitting funds from your CIMB account to a beneficiary's bank account in another country. TTs are generally suitable for larger amounts and offer a high level of security.

* Key Features of CIMB's Foreign Telegraphic Transfer:

* Wide Reach: CIMB's TT service allows you to send money to over 200 countries worldwide.

* Currency Options: Supports transfers in over 20 currencies, allowing you to send money in the recipient's local currency or a major international currency.

* Security: TTs are processed through a secure network, ensuring the safety of your funds.

* Tracking: You can typically track the progress of your TT transfer online through CIMB Clicks or the OCTO App.

* Competitive Exchange Rates: CIMB offers attractive foreign exchange rates, which can significantly impact the overall cost of your transfer.

* How to Initiate a Foreign Telegraphic Transfer with CIMB:

1. Log in to CIMB Clicks Web or CIMB OCTO App: Access your CIMB account through the online banking platform or mobile app.

2. Navigate to the "Transfer" or "Overseas Transfer" Section: Look for the option to initiate an international transfer.

3. Select "Foreign Telegraphic Transfer (TT)": Choose this option from the available transfer methods.

4. Enter Beneficiary Details: Provide accurate information about the recipient, including their full name, bank name, bank address, account number, and SWIFT/BIC code. The SWIFT/BIC code is a unique identifier for the beneficiary's bank and is crucial for ensuring the transfer reaches the correct destination.

5. Enter Transfer Details: Specify the amount you wish to send, the currency, and the purpose of the transfer.

6. Review and Confirm: Carefully review all the details before confirming the transaction.

7. Authentication: You may be required to authenticate the transaction using a secure authentication method, such as a One-Time Password (OTP) sent to your registered mobile number.

* Important Considerations for Foreign Telegraphic Transfers:

* Beneficiary Bank Charges: Be aware that the beneficiary's bank may levy charges for receiving the TT. These charges are typically deducted from the transferred amount.

* Intermediary Bank Charges: In some cases, the TT may pass through intermediary banks, which may also deduct fees.

* Processing Time: TTs typically take 1-5 business days to reach the beneficiary, depending on the destination country and the banks involved.

* Accuracy of Information: Providing accurate beneficiary details is crucial to avoid delays or rejection of the transfer. Double-check all information before confirming the transaction.

2. SpeedSend: A Faster Option for Sending Money

SpeedSend is CIMB's remittance service designed for faster international money transfers. It's particularly useful for sending smaller amounts urgently to specific countries.

* Key Features of CIMB's SpeedSend:

* Faster Processing: SpeedSend transfers are typically processed faster than TTs, often reaching the beneficiary within a shorter timeframe.

* Convenience: SpeedSend is easily accessible through CIMB Clicks and the OCTO App.

* Competitive Rates: CIMB offers competitive exchange rates for SpeedSend transfers.cimb transfer money overseas

* Specific Country Coverage: While SpeedSend offers fast transfers, it may be limited to specific countries. Check the availability of SpeedSend for your desired destination.

* How to Initiate a SpeedSend Transfer with CIMB:

Additional information

| Dimensions | 8.1 × 5.5 × 1.1 in |

|---|