401k withdrawal overseas | moving 401k to home country

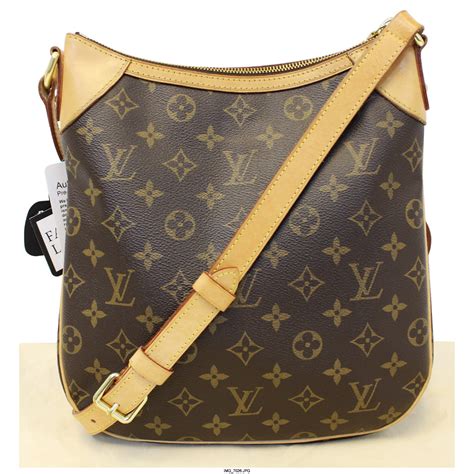

$261.00

In stock

For many, the thought of retiring overseas evokes images of sun-drenched beaches, vibrant cultures, and a life of relaxation. However, financial planning for such a move requires careful consideration, especially when it comes to your 401(k). Understanding the rules and regulations surrounding 401(k) withdrawals while living abroad is crucial to avoid unexpected tax consequences and ensure a comfortable retirement. This article delves into the intricacies of 401(k) withdrawals for those living outside the United States, covering various scenarios and providing insights into managing your retirement funds effectively.

The Universal Truth: US Taxation Remains

One fundamental principle to grasp is that the United States taxes its citizens and permanent residents (Green Card holders) on their worldwide income, regardless of where they reside. This principle extends to 401(k) withdrawals. For both U.S. residents and non-resident aliens, the rules regarding early withdrawal penalties and income tax apply equally. This means that any withdrawal from your 401(k) will be treated as income by the U.S. government and subjected to federal income tax.

Furthermore, if you are under the age of 59 ½, you will likely face a 10% early withdrawal penalty on top of the regular income tax, unless you qualify for a specific exception. These exceptions are limited and typically involve dire financial circumstances, death, or disability.

Understanding Your Options: More Than Just Withdrawing

While withdrawing your 401(k) might seem like the most straightforward option, especially if you need funds to establish your life abroad, it’s often the least tax-efficient. Consider these alternative strategies before resorting to a full or partial withdrawal:401k withdrawal overseas

* Leaving Your 401(k) Intact: The simplest option is often the best. If you don’t need the funds immediately, leaving your 401(k) invested allows it to continue growing tax-deferred. This can be particularly beneficial if you plan to return to the U.S. in the future or foresee needing the funds later in your retirement. Maintain contact with your 401(k) administrator to ensure they have your updated contact information and beneficiaries.

* Rolling Over to an IRA: While you can't directly "move" your 401(k) to a foreign retirement account (more on that later), you can roll it over into a Traditional IRA or a Roth IRA (if eligible). This maintains the tax-advantaged status of your retirement savings. A Traditional IRA offers continued tax-deferred growth, while a Roth IRA offers tax-free withdrawals in retirement (provided certain conditions are met). The decision between a Traditional and Roth IRA depends on your current and projected future tax bracket.

* Strategic Withdrawals: If you need access to your funds, consider a phased withdrawal strategy. Instead of taking a large lump sum, withdraw smaller amounts over time. This can help you manage your tax liability by potentially keeping you in a lower tax bracket. Consult with a tax advisor to determine the most tax-efficient withdrawal strategy for your specific circumstances.

Moving 401k to Home Country: A Complex (and Usually Impossible) Task

The idea of "moving" your 401(k) to your home country is a common desire, but unfortunately, it's generally not possible in a direct, straightforward manner. The U.S. 401(k) system is designed to be used within the U.S. financial framework. You cannot simply transfer your 401(k) account to a foreign retirement account or financial institution.

The closest alternative is to withdraw the funds and then potentially invest them in your home country. However, as mentioned earlier, this triggers U.S. income tax and potentially the 10% early withdrawal penalty. Furthermore, you'll need to consider the tax implications in your home country, as the withdrawn funds may be subject to taxation there as well. This could result in double taxation, significantly reducing the amount you actually have available for investment.

Transfer 401k to Foreign Retirement: The Reality Check

As stated above, a direct transfer of your 401(k) to a foreign retirement account is typically not permitted. The U.S. and foreign retirement systems operate under different regulations and tax treaties, making a direct transfer administratively and legally complex. While some individuals may attempt to find loopholes or creative solutions, these are often fraught with risks and potential compliance issues. It is strongly advised to avoid any arrangements that seem too good to be true or lack transparency. Consulting with a qualified cross-border financial advisor is crucial before considering any unconventional strategies.

401k for Non-US Residents: Understanding the Rules

The term "non-US resident" can refer to different situations. It could mean a non-resident alien working in the U.S. on a visa, or a U.S. citizen living abroad and considered a non-resident for tax purposes in their country of residence.

Additional information

| Dimensions | 6.3 × 3.5 × 2.4 in |

|---|